CounterPath Reports Fourth Quarter and Fiscal 2012 Financial Results

Vancouver, BC, Canada — July 25, 2014

CounterPath Corporation (“CounterPath” or the “Company”) (NASDAQ: CPAH) (TSX-V: CCV), an award-winning provider of desktop and mobile VoIP software products and solutions, today announced the financial and operating results for its fourth quarter and fiscal year ended April 30, 2012.

Fourth Quarter Financial and Operating Highlights

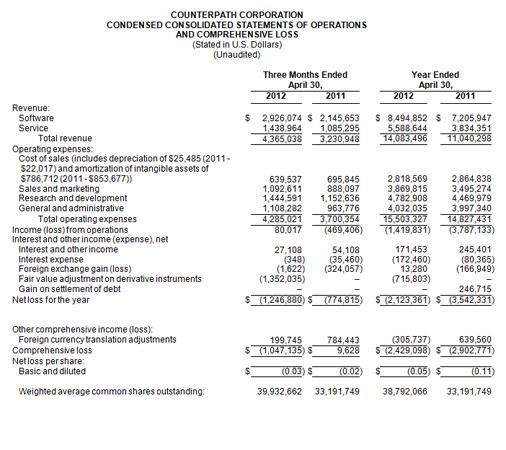

- Record quarterly revenue of $4.4 million, a 35% increase year-over-year and a 25% increase over the last quarter.

- GAAP gross margin of 85%. Non-GAAP gross margin of 88%.

- Operating income of $0.1 million compared to an operating loss of $0.5 million for the fourth quarter of fiscal year 2011.

- A net loss of $1.2 million or a loss of $0.03 per share, compared to a net loss of $0.8 million or a loss of $0.02 per share, for the quarter ended April 30, 2011. The $1.2 million net loss includes a non-cash $1.4 million charge for fair value adjustment on derivative instruments attributable to a change in fair value of certain warrants, the key determinant of which is proportionate to the increase in the Company’s share price.

- Non-GAAP net income of $0.4 million or $0.01 per share compared to a non-GAAP net loss of $0.4 million or a loss of $0.01 per share for the quarter ended April 30, 2011.

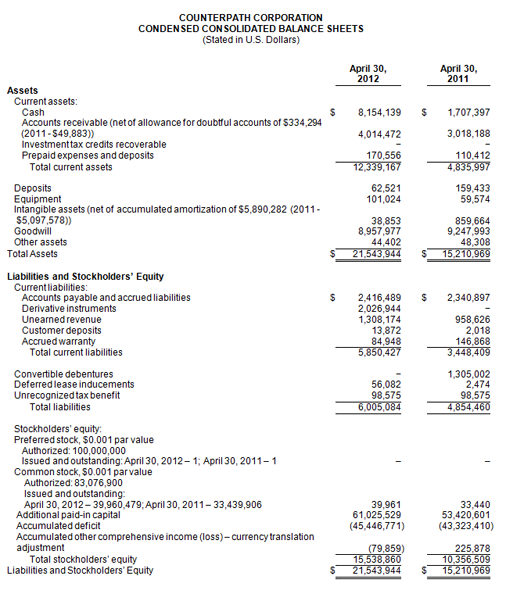

- Cash of $8.2 million as of April 30, 2012.

Fiscal 2012 Financial and Operating Highlights

- Record annual revenue of $14.1 million, a 28% increase over last year.

- GAAP gross margin of 80%. Non-GAAP gross margin of 86%.

- Non-GAAP operating income of $0.1 million compared to a non-GAAP operating loss of $2.1 million last year.

- A net loss of $2.1 million or a loss of $0.05 per share compared to a net loss of $3.5 million or a loss of $0.11 per share last year. The $2.1 million net loss includes a non-cash $0.7 million charge for fair value adjustment on derivative instruments.

- Non-GAAP net income of $0.1 million or $0.00 per share, compared to a non-GAAP net loss of $1.9 million or a net loss of $0.06 per share last year.

“Another solid quarter boosted by strong mobile application demand enabled CounterPath to post record quarterly and annual revenues,” stated Donovan Jones, President and Chief Executive Officer. “During fiscal 2012, we also controlled costs and improved profitability, evidenced by our first positive operating income in the fourth quarter and our first positive non-GAAP net income for the full fiscal year.”

“Over the past year, CounterPath’s desktop and mobile solutions have been implemented by several major telecom, OEM and enterprise customers in North America and Europe, while our Bria mobile apps climbed the rankings of both the Apple iTunes App Store and Android Google Play. We enter fiscal 2013 with a strong balance sheet and the products and solutions to address the large and growing softphone market,” continued Jones.

Recent Business Highlights

- Received the BCTIA Technology Impact Award for Achievements on Rogers One Number™ contract by offering a web-based VoIP complement to Rogers’ mobile offerings launched in February 2012.

- Launched cloud-based Client Configuration Server hosted offering which allows IT managers to deploy, configure and manage softphone endpoints remotely.

- Granted U.S. Patent “Method and System for Extending Services to Cellular Devices”, a patent describing how business users may access enterprise telephony features on their mobile devices such as 4-digit extension dialing, ad hoc conferencing and call transfers.

- Received 2012 Most Innovative VoIP Product Award by the Internet Telephony Service Providers Association (ITSPA), the UK’s industry body for Internet telephony service providers for Bria iPad Edition mobile softphone.

- Subsequent to year end, completed private placement on June 19, 2012 for gross proceeds of $3.6 million.

- Subsequent to year end, began trading on The NASDAQ Stock Market LLC on July 11, 2012 under the symbol CPAH.

Subsequent to the year end, on July 19, 2012, the Company granted $215,000 of deferred share units (“DSUs”) to six non-employee directors and $175,000 of DSUs to two officers and one employee pursuant to its deferred share plan (“DSUP”). The number of DSUs issued is based on the dollar amount granted divided by the closing market share price today. Each DSU provides the holder thereof the right to exchange the DSU, once vested, into one share of common stock of the Company under the terms and conditions of the DSUP. The DSUs granted to the six non-employee directors in lieu of cash retainers for directorship, vest immediately and the DSUs granted to the two officers and one employee vest as to one-third of the DSUs on the first, second and third anniversary of the date of the grant.

Conference Call Information

CounterPath will host an investor conference call and live webcast today at 11:00 a.m. ET to discuss its financial results for the fourth quarter and fiscal year ended April 30, 2012. To access the conference call by telephone, dial 647-427-7450 or 1-888-231-8191. Please connect approximately 15 minutes prior to the beginning of the call to ensure participation. A question and answer session for analysts and institutional investors will follow management’s presentation.

A live audio webcast of the conference call will be available at www.newswire.ca. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. The webcast will be archived for 30 days.

A rebroadcast will be available to listeners until 12 a.m. ET on Thursday, July 26, 2012. To access the rebroadcast, please dial 416-849-0833 or 1-855-859-2056 and enter passcode 96815733, followed by the number sign.

Forward-Looking Statements

This news release contains “forward-looking statements”. Statements in this news release, which are not purely historical, are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future.

It is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others: (1) general economic conditions as they affect CounterPath and its current and prospective customers, including a continued downturn in general economic conditions internationally, (2) the Company’s ability to remain competitive as other better financed parties develop and release competitive products, the Company’s ability to control its operating expenses, which may adversely affect its financial condition, (3) a decline in our stock price or insufficient investor interest in the Company’s securities which may impact on the Company’s ability to raise additional financing as required, (4) the impact of intellectual property litigation that could materially and adversely affect our business, (5) the success by the Company of the sales of its current and new products, (6) the impact of technology changes on the Company’s products and on our industry, (7) the failure to develop new and innovative products using the Company’s technologies, (8) the potential dilution to shareholders or overhang on our share price of our outstanding stock options and warrants. Readers should also refer to the risk disclosures outlined in the Company’s quarterly reports on Form 10-Q or Form 10-Q/A, or in the annual reports on Form 10-K or Form 10-K/A, and the Company’s other disclosure documents filed from time-to-time with the Securities and Exchange Commission at www.sec.gov and the Company’s interim and annual filings and other disclosure documents filed from time-to-time on SEDAR at www.sedar.com.

About CounterPath

CounterPath’s SIP-based VoIP softphones are changing the face of telecommunications. An industry and user favorite, Bria softphones for desktop and mobile devices, together with the company’s server applications and Fixed Mobile Convergence (FMC) solutions, enable service providers, OEMs and enterprises large and small around the globe to offer a seamless and unified communications experience across both fixed and mobile networks. Standards-based, cost-effective and reliable, CounterPath’s award-winning solutions power the voice and video calling, messaging, and presence offerings of customers such as Alcatel-Lucent, AT&T, Verizon, BT, Mobilkom Austria, Rogers, Avaya, BroadSoft, Cisco Systems, GENBAND, Metaswitch Networks, Mitel and NEC. For more information please visit mrkt-stg.counterpath.com.

Disclaimer: Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contacts:

David Karp

Chief Financial Officer, CounterPath

[email protected]

(604) 628-9364

Craig Armitage

Equicom Group

[email protected]

(416) 815-0700 x278

(TABLES TO FOLLOW)

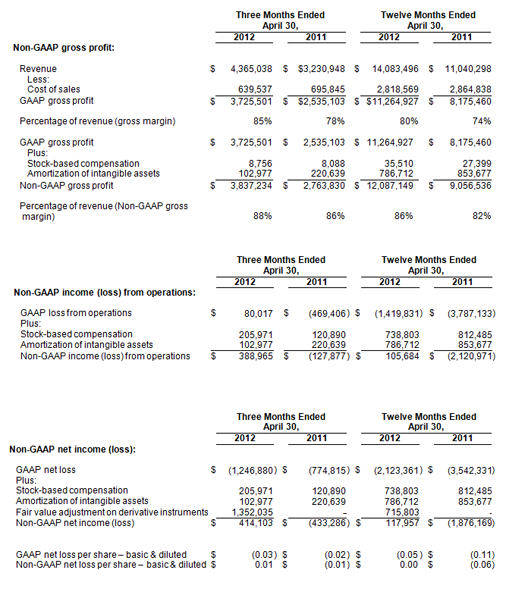

Non-GAAP Financial Measures

This news release contains “non-GAAP financial measures”. The non-GAAP financial measures in this news release consist of non-GAAP gross profit and non-GAAP income (loss) from operations which exclude non-cash stock-based compensation and amortization of intangible asset charges relative to gross profit and income (loss) from operations calculated in accordance with GAAP. The non-GAAP financial measures also include non-GAAP net income (loss) which excludes non-cash stock-based compensation, amortization of intangible assets and fair value adjustment on derivative instruments charges relative to income (loss) calculated in accordance with GAAP. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. CounterPath utilizes both GAAP and non-GAAP financial measures to assess what it believes to be its core operating performance and to evaluate and manage its internal business and assist in making financial operating decisions. CounterPath believes that the inclusion of non-GAAP financial measures, together with GAAP measures, provides investors with an alternative presentation useful to investors’ understanding of CounterPath’s core operating results and trends.

Reconciliation to GAAP (Unaudited)