CounterPath Reports First Quarter Fiscal 2020 Financial Results

Vancouver, BC, Canada —Sep 12, 2019 — CounterPath Corporation (NASDAQ: CPAH) (TSX: PATH) (the “Company” or “CounterPath”), a global provider of award-winning Unified Communications (UC) solutions for enterprises and service providers, today announced the financial and operating results for its quarter ended July 31, 2019, being the first quarter of fiscal year 2020.

First Quarter Financial Highlights (unaudited)

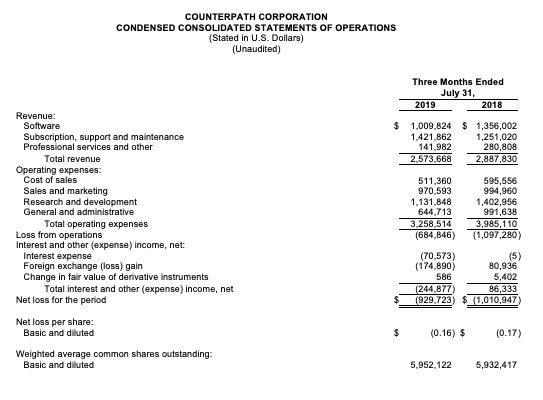

- Revenue of $2.6 million compared to revenue of $2.9 million for the first quarter of fiscal 2019.

- Growth in subscription, support and maintenance revenue (revenue of a recurring nature) of 14% for the quarter compared to the first quarter of fiscal 2019.

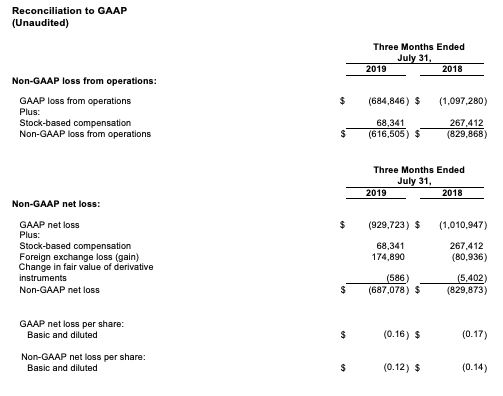

- Non-GAAP loss from operations of $0.6 million compared to non-GAAP loss from operations of $0.8 million for the first quarter of fiscal 2019.

- Net loss of $0.9 million, or $0.16 per share, compared to net loss of $1.0 million, or $0.17 per share, for the first quarter of fiscal 2019.

- Non-GAAP net loss of $0.7 million, or $0.12 per share, compared to non-GAAP net income of $0.8 million, or $0.14 per share, for the first quarter of fiscal 2019.

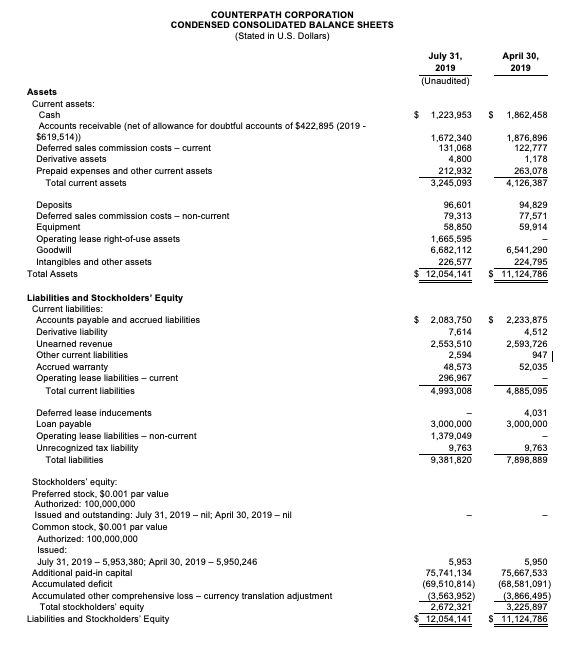

- Cash of $1.2 million as of July 31, 2019 compared to cash of $1.9 million as of April 30, 2019.

Management Commentary

“We continue to make significant progress growing our recurring revenue business, decreasing reliance on our legacy perpetual licensing model. Recurring revenue contributed 55% of total revenue in the quarter and grew 14% over the same quarter last year,” said David Karp, interim CEO, and CFO. “Contributing to this growth included the success of our channel partner program, which is now exclusively a Software-as-a-Service (SaaS) business for CounterPath. We have expanded our channel program breadth by leveraging our direct team and channel partners for opportunities that do not require customization. We have also introduced our collaboration solution in new markets. We have expanded our operations to support hosted collaboration with server infrastructure in North America, Europe and South Africa. The new deployments support our hosted cloud communications and collaboration services in these key markets to assist our channel partner roll-out. Our channel partner program allows CounterPath to leverage its sales force, particularly in regions where the company does not have a physical presence. Our focus on verticals and underserved markets provides higher margins that best align with CounterPath’s quality, reliability, and platform interoperability. These opportunities include call center, retail, and health care verticals and the underserved SMB market for Unified Communications and Collaboration (UCC).”

Recent Business Highlights

- LCB Solutions Inc., a California-based cloud VoIP provider to small and medium sized businesses, selected CounterPath to provide customized, white-labelled Bria® applications that are easily managed through the Stretto™ Platform.

- TMC, a global, integrated media company named Bria Teams as a 2019 Unified Communications Product of the Year Award winner.

- cleverbridge, a provider of subscription commerce solutions for monetizing digital goods, online services and SaaS, selected CounterPath to provide customized, white-labelled Bria softphone applications to deliver improved, multi-channel customer experiences while streamlining its call center operations and improving agent productivity.

- WinTech, a Las Vegas-based global technology solution developer, selected CounterPath to deliver integrated high-definition voice and video communication solutions for ALICE®, a virtual receptionist and visitor management solution.

Financial Overview

(All amounts in U.S. dollars and in accordance with accounting principles generally accepted in the United States (“GAAP”) unless otherwise specified – unaudited).

Revenue was $2.6 million for the quarter ended July 31, 2019 compared to $2.9 million for the same quarter in the last fiscal year. Software revenue was $1.0 million compared to $1.4 million for the same quarter in the last fiscal year, subscription, support and maintenance revenue was $1.4 million compared to $1.3 million for the same quarter in the last fiscal year, and professional services and other revenue was $0.1 million compared to $0.3 million for the same quarter in the last fiscal year.

Operating expenses for the quarter ended July 31, 2019 were $3.3 million compared to $4.0 million for the same quarter in the last fiscal year. Operating expenses for the quarter ended July 31, 2019 included a non-cash stock-based compensation expense of $0.1 million (2018 – $0.3 million). Cost of sales was $0.5 million for the quarter ended July 31, 2019 compared to $0.6 million for the same quarter in the last fiscal year. Sales and marketing expenses were $1.0 million for the quarter ended July 31, 2019 compared to $1.0 million for the same quarter last fiscal year. For the quarter ended July 31, 2019, research and development expenses were $1.1 million and general and administrative expenses were $0.6 million compared to $1.4 million and $1.0 million, respectively, for the same quarter in the last fiscal year.

Interest and other (expense) income, net for the quarter ended July 31, 2019 was ($0.2) million compared to $0.1 million for the same quarter in the last fiscal year. Interest and other (expense) income, net was primarily comprised of a foreign exchange loss of $0.2 million, compared to a foreign exchange gain of $0.1 million for the same quarter in the last fiscal year. The foreign exchange gain (loss) represents the gain (loss) on account of translation of the intercompany accounts of the Company’s subsidiary which are maintained in Canadian dollars and transactional gains and losses resulting from transactions denominated in currencies other than U.S. dollars.

The net loss for the quarter ended July 31, 2019 was $0.9 million, or $0.16 per share, compared to a net loss of $1.0 million, or $0.17 per share, for the same quarter in the last fiscal year. As of July 31, 2019, the Company had $1.2 million in cash, compared to $1.9 million at April 30, 2019.

Forward-Looking Statements

This news release contains “forward-looking statements”. Statements in this news release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, outlook, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others: (1) the lack of cash flow which may affect the Company’s ability to continue as a going concern; (2) the variability in the Company’s sales from reporting period to reporting period due to extended sales cycles as a result of selling the Company’s products through channel partners or the length of time of deployment of the Company’s products by its customers; (3) the Company’s ability to manage its operating expenses, which may adversely affect its financial condition and ability to continue to operate as a going concern; (4) the Company’s ability to remain competitive as other better financed competitors develop and release competitive products; (5) a decline in the Company’s stock price or insufficient investor interest in the Company’s securities which may impact the Company’s ability to raise additional financing as required or may cause the Company to be delisted from a stock exchange on which its common stock trades; (6) the impact of intellectual property litigation that could materially and adversely affect the Company’s business; (7) the success by the Company of the sales of its current and new products; (8) the impact of technology changes on the Company’s products and industry; (9) the failure to develop new and innovative products using the Company’s technologies including the refresh of our Software-as-a Service (SaaS) solution; and (10) the potential dilution to shareholders or overhang on the Company’s share price of its outstanding stock options. Readers should also refer to the risk disclosures outlined in the Company’s quarterly reports on Form 10-Q, the Company’s annual reports on Form 10-K, and the Company’s other disclosure documents filed from time-to-time with the Securities and Exchange Commission at www.sec.gov and the Company’s interim and annual filings and other disclosure documents filed from time-to-time on SEDAR at www.sedar.com.

About CounterPath

CounterPath Unified Communications solutions are changing the face of telecommunications. An industry and user favorite, Bria softphones for desktop, tablet and mobile devices, together with Stretto Platform™ server solutions, enable service providers, OEMs and enterprises large and small around the globe to offer a seamless and unified communications experience across any network. The Bria and Stretto combination enables an improved user experience as an overlay to the most popular UC and IMS telephony and applications servers on the market today. Standards-based, cost-effective and reliable, CounterPath’s award-winning solutions deliver high-quality voice and video calling, messaging, and presence offerings to our customers such as AT&T, Avaya, Bell Canada, BT, Liberty Global, Ribbon Communications, Uber and Vonex. Visit counterpath.com and follow @counterpath.

Contacts:

David Karp

Interim Chief Executive Officer, and Chief Financial Officer, CounterPath

[email protected]