CounterPath Reports Second Quarter Fiscal 2011 Financial Results

Vancouver, BC, Canada — July 28, 2014CounterPath Corporation (“CounterPath” or the “Company”) (OTCBB: CPAH; TSX-V: CCV), an award-winning provider of desktop and mobile VoIP software products and solutions, today announced the financial and operating results for the second quarter of fiscal year 2011.

Financial and operating highlights for the second quarter ended October 31, 2010 include:

- Revenue for the second quarter ended October 31, 2010 of $2.6 million compared to revenue of $2.2 million for the first quarter ended July 31, 2010, and $1.9 million for the second quarter ended October 31, 2009.

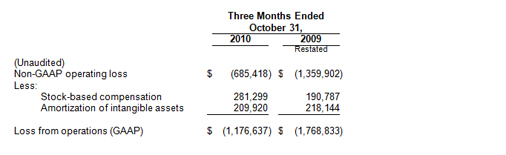

- A non-GAAP operating loss of $0.7 million for the second quarter compared to non-GAAP operating loss of $1.4 million for the second quarter ended October 31, 2009.

- A net loss for the second quarter of $0.8 million ($0.03 per share) compared to a net loss of $1.7 million ($0.6 per share) for the second quarter ended October 31, 2009.

- The entering into of a long-term strategic agreement with Metaswitch Networks, exposing CounterPath’s and Metaswitch’s joint solution to Metaswitch’s approximately 250 service provider customers. The agreement leverages CounterPath’s entire product suite comprised of desktop and mobile softphones and convergence servers.

- The introduction of NEC’s Smart Mobile Client, a sophisticated CounterPath solution for Fixed-Mobile Convergence (FMC) that extends the functionality and capabilities of NEC communication servers to market-leading smartphones. This solution is based on CounterPath’s Enterprise Mobility Gateway and mobile client offering.

- The expansion of CounterPath’s portfolio of patents and exclusive license protections for CounterPath’s FMC technologies with the granting of a patent for assigning single-number identity across multiple devices and networks and a patent for presence detection across fixed and mobile networks.

- The launch of the full featured Bria iPhone Edition 1.1 with multitasking, full SIP compliance, superior call quality to circuit-switched wireline and wireless voice, one-touch access to voicemail, Bluetooth support, multi-call management, and signaling and call encryption, enabling enterprise-class security.

- The closing of a $1.5 million private placement providing additional capital resources to fund operations.

“The market continues to improve for our products and our sales were strong this quarter, up 35% over the same quarter last year”, stated Donovan Jones, President and CEO, CounterPath. “We are seeing growth across all product lines providing support for a comment by NetworkWorld which recently reported that 70% of companies are increasing their deployment of softphones. The next phase of our strategy entails leveraging our OEM sales channels to reach a broader service provider and enterprise market. The announced efforts with Avaya, BroadSoft, Genesys, Metaswitch and NEC provide a solid foundation for this next growth period. In addition, we plan to increase sales of our recently launched iPhone and Android mobile phone applications by following the white label and customizable model that we have used successfully with our desktop softphone applications.”

Financial Results

(All amounts in U.S. dollars and in accordance with accounting principles generally accepted in the United States (“GAAP”) unless otherwise specified.)

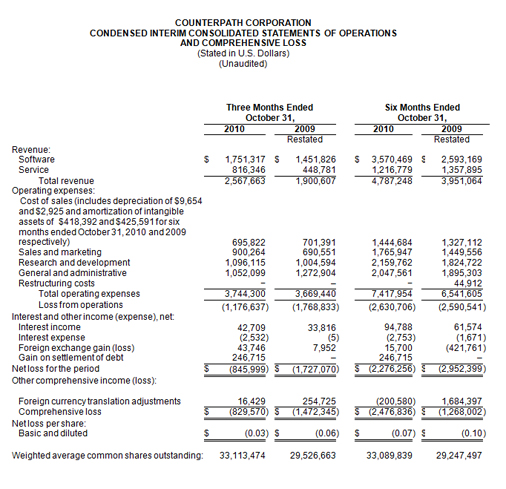

For the quarter ended October 31, 2010, revenue was $2.6 million compared to $1.9 million for the same quarter last year. Software revenue for the quarter ended October 31, 2010 was $1.8 million compared to $1.5 million for the same quarter last year. Service revenue for the quarter ended October 31, 2010 was $0.8 million compared to $0.4 million for same quarter last year.

Operating expenses for the quarter ended October 31, 2010 were $3.7 million compared to $3.7 million for the same quarter last year. Operating expenses for the quarter included a non-cash expense of $0.2 million for amortization of intangible assets and a non-cash stock-based compensation expense of $0.3 million.

Sales and marketing expenses were $0.9 million for the quarter ended October 31, 2010 compared to $0.7 million for same quarter last year. For the quarter ended October 31, 2010, research and development expenses were $1.1 million and general and administrative expenses were $1.1 million, compared to $1.0 million and $1.3 million, respectively, for the same quarter last year.

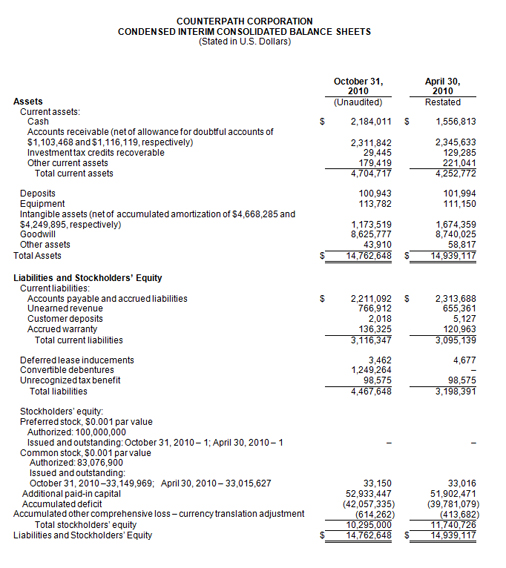

The net loss for the quarter ended October 31, 2010 was $0.8 million, or a loss of $0.03 per share, compared to a net loss of $1.7 million, or a loss of $0.06 per share, for the quarter ended October 31, 2009. At October 31, 2010, the Company had $2.2 million in cash, compared to $1.6 million at April 30, 2010. At October 31, 2010, the Company’s working capital was $1.6 million, compared to $1.2 million at April 30, 2010.

Subsequent to the end of the quarter, on December 14, 2010, the Company granted 40,000 stock options each to two non-employee directors pursuant to its stock option plan. Each stock option entitles the holder thereof the right to purchase one share of common stock at $1.90 per share under the terms and conditions of the plan. The options vest in the amount of 12.5% on the date which is six months from the date of grant and then beginning in the seventh month at 1/42 per month for 42 months, at which time the options are fully vested.

About CounterPath

CounterPath Corporation is an award-winning provider of innovative desktop and mobile VoIP software products and solutions. The Company’s product suite includes SIP-based softphones, server applications and Fixed Mobile Convergence (FMC) solutions that enable service providers, enterprises and Original Equipment Manufacturers (OEM) to cost-effectively integrate voice, video, presence and Instant Messaging (IM) applications into their VoIP offerings and extend functionality across both fixed and mobile networks.

CounterPath’s customers include some of the world’s largest telecommunications service providers and network equipment providers including AT&T, Verizon, BT (British Telecommunications PLC), Mobilkom Austria, Avaya, Cisco Systems, Metaswitch Networks and Mitel.

For more information please visit mrkt-stg.counterpath.com.

Non-GAAP Financial Measures

This news release contains “non-GAAP financial measures”. The non-GAAP financial measures in this news release consist of non-GAAP operating losses which exclude non-cash stock-based compensation and amortization of intangible asset charges relative to operating losses calculated in accordance with GAAP. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. CounterPath utilizes both GAAP and non-GAAP financial measures to assess what it believes to be its core operating performance and to evaluate and manage its internal business and assist in making financial operating decisions. CounterPath believes that the inclusion of non-GAAP financial measures, together with GAAP measures, provides investors with an alternative presentation useful to investors’ understanding of CounterPath’s core operating results and trends.

Reconciliation to GAAP

Forward-Looking Statements

This news release contains “forward-looking statements”. Statements in this news release which are not purely historical, are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future, such as the following: (1) the market continues to improve for our products; (2) the next phase of our strategy entails leveraging our OEM sales channels to reach a broader service provider and enterprise market; and (3) we plan to increase sales of our recently launched iPhone and Android mobile phone applications by following the white label and customizable model that we have used successfully with our desktop softphone applications.

It is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others: (1) the failure to develop new and innovative products using the Company’s technologies, (2) the Company’s ability to remain competitive as other parties develop and release competitive products, (3) the Company’s ability to retain the employees necessary to continue research and development of current and new products, (4) the success by the Company of the sales of its current and new products, (5) the impact of technology changes on the Company’s products and on the VoIP industry, (6) the compatibility of the Company’s products with new computer operating systems, (7) the rate of adoption by service providers and the general public of VoIP as a replacement for regular and cellular phone service, (8) general economic conditions as they affect CounterPath and its current and prospective customers, including a continued downturn in general economic conditions internationally, (9) the ability of the Company to control costs operating, general administrative and other expenses, and (10) insufficient investor interest in the Company’s securities which may impact on the Company’s ability to raise additional financing as required. Readers should also refer to the risk disclosures outlined in the Company’s quarterly reports on Form 10-Q or Form 10-Q/A, or in the annual reports on Form 10-K or Form 10-K/A, and the Company’s other disclosure documents filed from time-to-time with the Securities and Exchange Commission at www.sec.gov and the Company’s interim and annual filings and other disclosure documents filed from time-to-time on SEDAR at www.sedar.com.

Disclaimer: Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this release.

Contact

David Karp

Chief Financial Officer

CounterPath Corporation

+1.604.320.3344 ext 1110

[email protected]

(TABLES TO FOLLOW)