CounterPath Reports Second Quarter Fiscal 2021 Financial Results

VANCOUVER, BC, Canada — December 14, 2020 — CounterPath Corporation (NASDAQ: CPAH) (TSX: PATH) (the “Company” or “CounterPath”), a global provider of award-winning Unified Communications (UC) solutions for enterprises and service providers, today announced the financial and operating results for its quarter ended October 31, 2020, being the second quarter of fiscal year 2021.

Second Quarter Financial Highlights (unaudited)

- Revenue of $3.6 million for the second quarter of fiscal 2021, an increase of 34% compared to revenue of $2.7 million for the second quarter of fiscal 2020.

- Subscription, support, and maintenance revenue (revenue of a recurring nature) for the second quarter of fiscal 2021 grew by 53% year-over-year to $2.3 million, and represented 64% of overall revenue.

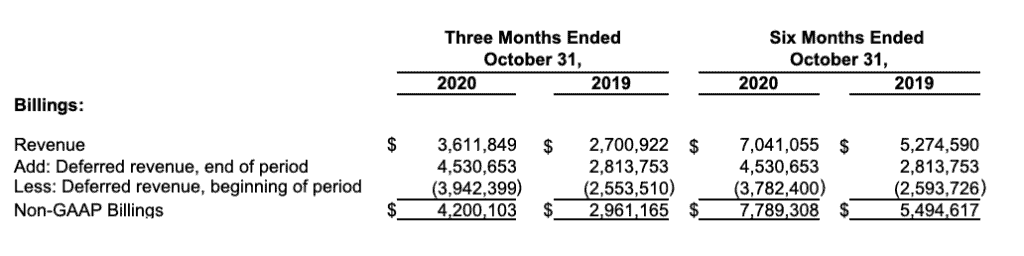

- Billings (revenue plus change in deferred revenue) increased by 40% to $4.2 million for the second quarter of fiscal 2021, compared to $3.0 million for the second quarter of fiscal 2020.

- Gross margin of 84% in the second quarter of fiscal 2021, compared to gross margin of 79% in the second quarter of fiscal 2020.

- Income from operations of $0.2 million for the second quarter of fiscal 2021, compared to loss from operations of $0.7 million for the second quarter of fiscal 2020.

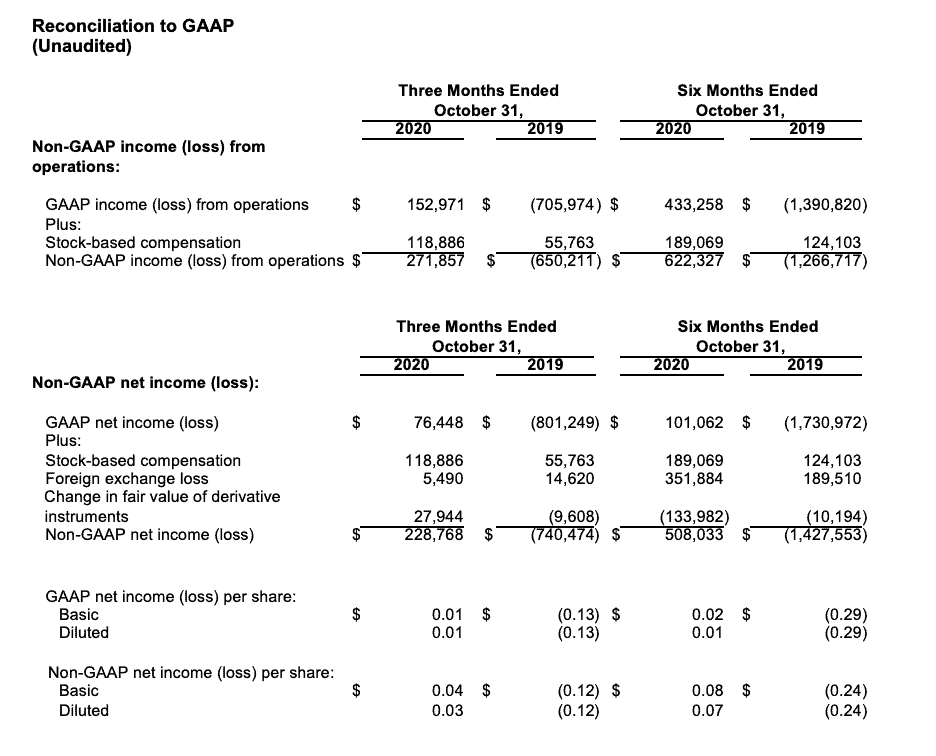

- Non-GAAP income from operations of $0.3 million for the second quarter of fiscal 2021, compared to non-GAAP loss from operations of $0.7 million for the second quarter of fiscal 2020.

- Net income of $0.1 million, or $0.01 per share, for the second quarter of fiscal 2021, compared to net loss of $0.8 million, or $0.13 per share, for the second quarter of fiscal 2020.

- Non-GAAP net income of $0.2 million, or $0.04 per share, for the second quarter of fiscal 2021, compared to non-GAAP net loss of $0.7 million, or $0.12 per share, for the second quarter of fiscal 2020.

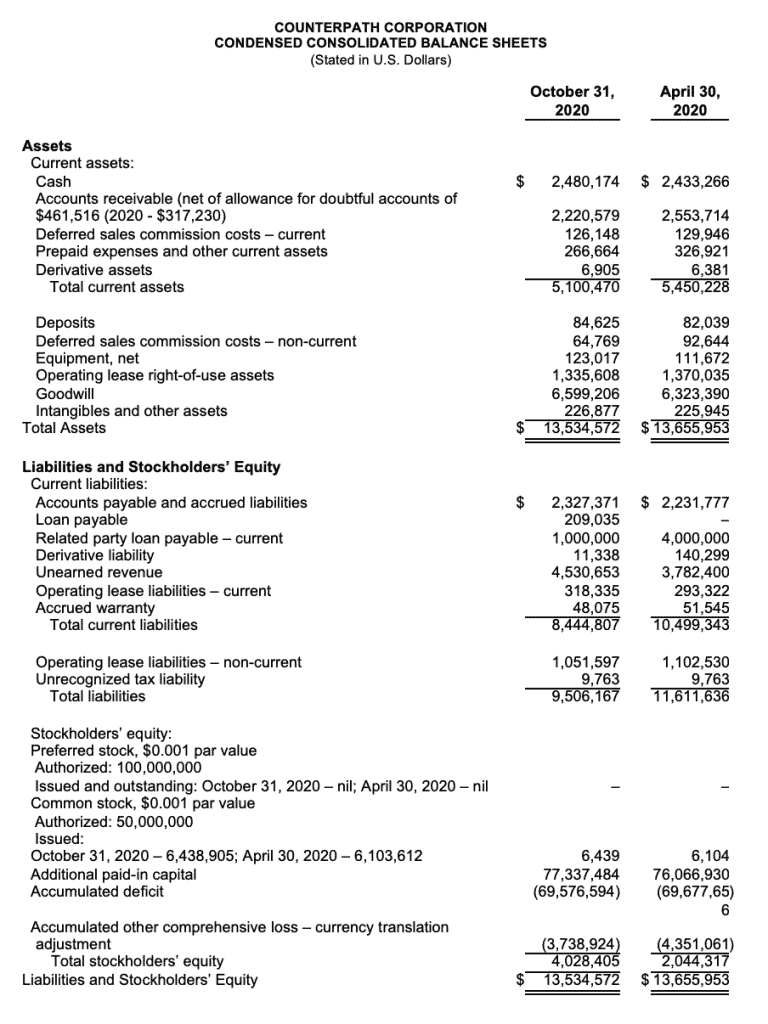

- Cash of $2.5 million as of October 31, 2020 compared to $2.4 million as of April 30, 2020.

Management Commentary

“It was another strong quarter, owing in part to our solutions contributing to the work from home initiatives undertaken as a result of the COVID-19 pandemic” said David Karp, CEO of CounterPath. “While we are optimistic about our recent upward trends, we are also preparing for seasonal challenges associated with the winter holidays in this current quarter, as well as continued uncertainty relating to the ongoing COVID-19 pandemic.”

“On December 7, 2020, we announced that CounterPath had entered into a Merger Agreement with Alianza, Inc., a leading cloud communications platform for service providers, pursuant to which Alianza has agreed to acquire CounterPath in an all-cash transaction for US$3.49 per share, representing a premium of approximately 27.4% to the prior 30-day average closing price of our common stock on the Nasdaq Capital Market. Alianza’s cloud voice solutions, when combined with CounterPath’s unified communication solutions will enable the delivery of a complete communications platform to our shared customer base, and we are excited to join with Alianza which is anticipated to close in the first quarter of 2021.”

Recent Business Highlights

- Developed a white-labelled Bria Enterprise solution for Ubefone, a cloud telephony and VoIP operator based in France

- Partnered with OMNIVIGIL, a leading Quebec and Ontario telecoms reseller, who is deploying Bria Enterprise solutions across the region in direct response to increased remote working needs

- Announced that the Company’s Bria® for Call Center solution has enabled SpeechLogix to create the XLogix® Platform, an application that increases agent performance and maximizes efficiency to improve contact center operations

- Announced that the Company’s partnership with Telico has extended Telico’s VoIP offering by allowing the company to cater to remote working conditions established due to the global pandemic

Financial Overview

(All amounts in U.S. dollars and in accordance with accounting principles generally accepted in the United States (“GAAP”) unless otherwise specified – unaudited).

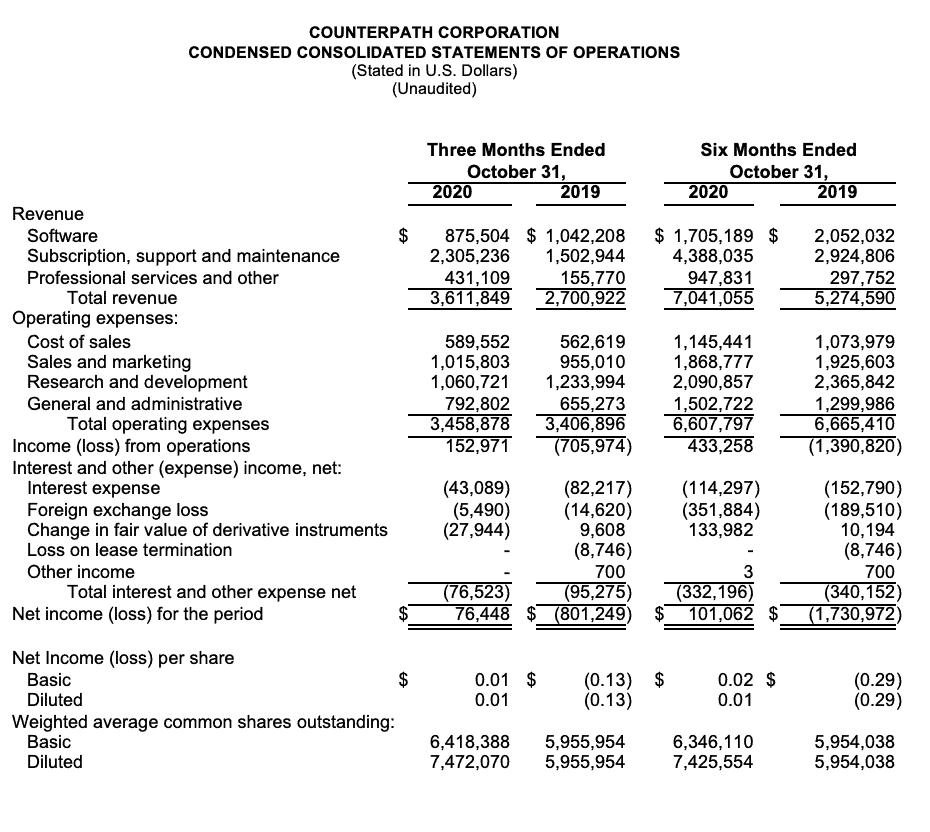

Revenue was $3.6 million for the quarter ended October 31, 2020, compared to $2.7 million for the same quarter in the last fiscal year. Software revenue was $0.9 million, compared to $1.0 million for the same quarter in the last fiscal year, subscription, support, and maintenance revenue was $2.3 million compared to $1.5 million for the same quarter in the last fiscal year, and professional services and other revenue was $0.4 million compared to $0.2 million for the same quarter in the last fiscal year.

Operating expenses for the quarter ended October 31, 2020, were $3.5 million compared to $3.4 million for the same quarter in the last fiscal year. Operating expenses for the quarter ended October 31, 2020 included a non-cash stock-based compensation expense of $0.1 million (2019 – $0.1 million). Cost of sales was $0.6 million for the quarter ended October 31, 2020, compared to $0.6 million for the same quarter in the last fiscal year. Sales and marketing expenses were $1.0 million for the quarter ended October 31, 2020, compared to $1.0 million for the same quarter last fiscal year. For the quarter ended October 31, 2020, research and development expenses were $1.1 million, and general and administrative expenses were $0.8 million compared to $1.2 million and $0.7 million, respectively, for the same quarter in the last fiscal year.

Interest and other (expense) income, net for the quarter ended October 31, 2020, was ($0.1) million compared to ($0.1) million for the same quarter in the last fiscal year. Interest and other (expense) income, net was primarily comprised of interest expense of $0.04 million related to the related party loan payable and a loss on fair value of derivative instruments of $0.03 million, compared to a foreign exchange loss of $0.01 million and a gain on fair value of derivative instruments of $0.01 million for the same quarter in the last fiscal year. The foreign exchange gain (loss) represents the gain (loss) on account of translation of the intercompany accounts of the Company’s subsidiary which are maintained in Canadian dollars and transactional gains and losses resulting from transactions denominated in currencies other than U.S. dollars.

The net income for the quarter ended October 31, 2020 was $0.01 million, or $0.01 per share, compared to a net loss of $0.8 million, or $0.13 per share, for the same quarter in the last fiscal year. As of October 31, 2020, the Company had $2.5 million in cash, compared to $2.4 million at April 30, 2020.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Transaction”) with Alianza, Inc. (“Alianza”), the Company plans to file relevant materials with the United States Securities and Exchange Commission (the “SEC”), including a proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, the Company will mail the definitive proxy statement to each stockholder entitled to vote at the meeting of the Company’s stockholders relating to the Transaction. INVESTORS AND STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The definitive proxy statement, the preliminary proxy statement, and other relevant materials in connection with the Transaction (when they become available) and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov). In addition, security holders will be able to obtain free copies of the proxy statement from the Company by contacting Chief Executive Officer by mail at Attn: Chief Executive Officer, Suite 300, One Bentall Centre, 505 Burrard Street, Vancouver, British Columbia V7X 1M3, Canada.

Certain Information Regarding Participants

CounterPath, Alianza, and their respective directors and executive officers may be deemed, under SEC rules, to be participants in the solicitation of proxies from CounterPath’s stockholders in connection with the proposed transaction. Information about the directors and executive officers of CounterPath is set forth in its proxy statement for CounterPath’s annual meeting of stockholders held on September 24, 2020, which was filed with the SEC on August 21, 2020, as supplemented by the Company’s current report on Form 8-K filed with the SEC on September 15, 2020. To the extent holdings of such directors and executive officers in CounterPath’s securities are not reported, or have changed since the amounts described in the proxy statement for CounterPath’s annual meeting of stockholders held on September 24, 2020, such changes may be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at www.sec.gov.

Forward-Looking Statements

This news release contains “forward-looking statements”. Statements in this news release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, outlook, expectations or intentions regarding the future. Such forward-looking statements include, among other things, the following: (1) While we are optimistic about our recent upward trends, we are also preparing for seasonal challenges associated with the winter holidays in this current quarter, as well as continued uncertainty relating to the ongoing COVID-19 pandemic; and (2) Alianza’s cloud voice solutions, when combined with CounterPath’s unified communication solutions will enable the delivery of a complete communications platform to our shared customer base, and we are excited to join with Alianza which is anticipated to close in the first quarter of 2021.

The material assumptions supporting these forward-looking statements include, among others, that Alianza will have available sufficient cash or other sources of available funds by the closing date to pay for the shares of CounterPath and the payment of all fees, costs and expenses to be paid by Alianza related to the Transaction. It is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others: (1) any direct or indirect negative potential impact or harm that COVID-19 may actually have on the Company’s business or its potential/current clients’ businesses; (2) the lack of cash flow which may affect the Company’s ability to continue as a going concern; (3) the variability in the Company’s sales from reporting period to reporting period due to extended sales cycles as a result of selling the Company’s products through channel partners or the length of time of deployment of the Company’s products by its customers; (4) the Company’s ability to manage its operating expenses, which may adversely affect its financial condition and ability to continue to operate as a going concern; (5) the Company’s ability to remain competitive as other better financed competitors develop and release competitive products; (6) the impact of intellectual property litigation that could materially and adversely affect the Company’s business; (7) the success by the Company of the sales of its current and new products; (8) the impact of technology changes on the Company’s products and industry; (9) the failure to develop new and innovative products using the Company’s technologies including the refresh of the Company’s Software-as-a Service (SaaS) solution; (10) continuation or acceleration of the work at home movement; (11) CounterPath and Alianza being unable to realize the anticipated synergies from the Transaction; (12) CounterPath’s and Alianza’s ability to raise the additional funding that they may need to continue their business, capital expansion and sales activity; (13) the risks that the conditions to the closing of the Transaction are not satisfied, including the failure to obtain stockholder approvals for the Transaction in a timely manner or at all; (14) uncertainties as to the timing of the closing of the Transaction and the ability of each of CounterPath and Alianza to consummate the Transaction; (15) the risks related to the failure or delay in obtaining required approvals from the Toronto Stock Exchange, the Nasdaq Stock Market or any governmental or quasi-governmental entity necessary to consummate the Transaction; (16) risks related to the market price of the common stock of CounterPath; (17) significant transaction costs and unknown liabilities; (18) litigation or regulatory actions related to the Transaction; (19) risks related to Alianza’s ability to have sufficient cash or other sources of available funds by the closing date to pay for the shares of CounterPath and the payment of all fees, costs and expenses to be paid by Alianza related to the Transaction; and (20) the inherent uncertainties with mergers, acquisitions and other business combinations. Readers should also refer to the risk disclosures outlined in the Company’s quarterly reports on Form 10-Q, the Company’s annual reports on Form 10-K, and the Company’s other disclosure documents filed from time-to-time with the Securities and Exchange Commission at www.sec.gov and the Company’s interim and annual filings and other disclosure documents filed from time-to-time on SEDAR at www.sedar.com. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States and Canada.

About CounterPath

CounterPath Corporation (NASDAQ: CPAH) (TSX: PATH) is revolutionizing how people communicate in today’s modern mobile workforce. Its award-winning Bria solutions for desktop and mobile devices enable organizations to leverage their existing PBX and hosted voice call servers to extend seamless and secure unified communications and collaboration services to users regardless of their location and network. CounterPath technology meets the unique requirements of several industries, including the contact center, retail, warehouse, hospitality, and healthcare verticals. Learn more at counterpath.com and follow us on Twitter @counterpath.

Contacts:

David Karp

Chief Executive Officer

###

(TABLES TO FOLLOW)

Non-GAAP Financial Measures

This news release contains “non-GAAP financial measures”. The non-GAAP financial measures in this news release consist of non-GAAP income (loss) from operations which excludes non-cash stock-based compensation relative to income (loss) from operations calculated in accordance with GAAP and non-GAAP net income (loss) which excludes non-cash stock-based compensation, foreign exchange loss and change in fair value of derivative instruments relative to net income (loss) calculated in accordance with GAAP. The non-GAAP financial measures in this news release also include billings which is calculated as revenue recognized plus the change in deferred revenue from the beginning to the end of the applicable period. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. CounterPath utilizes both GAAP and non-GAAP financial measures to assess what it believes to be its core operating performance and to evaluate and manage its internal business and assist in making financial operating decisions. CounterPath believes that the inclusion of non-GAAP financial measures, together with GAAP measures, provides investors with an alternative presentation useful to investors’ understanding of CounterPath’s core operating results and trends.